A Trusted Forex Broker

Lime Trading (CY) Ltd is a leading international investment company providing its Clients with direct access to the major world stock and currency markets. Our Company is built by talented people who continually deliver our high levels of service. Together, we not only deliver a great trading experience for our Clients, but we also create a great Company to work for. Our Company provides a wide array of investment services:

- Brokerage Services

- Portfolio Management Services

- Investment Advice Services

- Foreign Exchange Services

- Investment Research and Financial Analysis Services

Lime Trading (CY) is subject to the oversight and legal framework of the European Securities and Markets Authority (ESMA) and is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 281/15. Additionally, Lime Trading (CY) is a member of the Investor Compensation Fund.

Lime Trading (CY) provides customers with direct access to the major world stock and currency markets. The company has strong international presence. The clients of Lime Trading (CY) are both individuals and legal entities.

The business, banking, legal and accounting procedures are patterned after the best European standards, aiming to minimize investment risk and to maximize reliability and trust.

The headquarters of Lime Trading (CY) are located at the heart of Limassol’s business district — the second largest town in Cyprus, nevertheless the most important tourist and commercial center and the largest harbor on the island.

| 💰 Account currency: |

USD, EUR, IDR, JPY, THB

|

|---|---|

| 🚀 Minimum deposit: | From $100 USD |

| ⚖️ Leverage: | Up to 1:300 (Max account) Products Offered: Forex, metals, energies, commodities, cryptos & indices |

| 💱 Spread: | Average spread for EUR/USD is 0.0 pips Commission: $3.5 USD per lot / per side |

| 🔧 Instruments: | Currency pairs (60+), CFDs on stocks (70+), indices (10), metals (4), energy resources (5) |

| 💹 Headquarters and License |

Regulated by the Cyprus Securities and Exchange Commission in accordance with license No.281/15 issued on 25/09/2015 Address: Lime Trading (CY) Ltd 10 Chrysanthou Mylona, MAGNUM HOUSE 3030 Limassol, Cyprus

|

Financial Instruments

Transferable securities

Money-market instruments

Units in collective investment undertakings

Options, futures, swaps, forward rate agreements and any other derivative contracts relating to securities, currencies, interest rates or yields, or other derivatives instruments, financial indices or financial measures which may be settled physically or in cash

Options, futures, swaps, forward rate agreements and any other derivative contracts relating to commodities that must be settled in cash or may be settled in cash at the option of one of the parties (otherwise than by reason of a default or other termination event).

Options, futures, swaps, and any other derivative contract relating to commodities that can be physically settled provided that they are traded on a regulated market or/and an MTF.

Options, futures, swaps, forwards and any other derivative contracts relating to commodities, that can be physically settled not otherwise mentioned in paragraph 6 of Part III and not being for commercial purposes, which have the characteristics of other derivative financial instruments, having regard to whether, inter alia, they are cleared and settled through recognised clearing houses or are subject to regular margin calls.

Derivative instruments for the transfer of credit risk.

Financial contracts for differences.

Options, futures, swaps, forward rate agreements and any other derivative contracts relating to climatic variables, freight rates, emission allowances or inflation rates or other official economic statistics that must be settled in cash or may be settled in cash at the option of one of the parties (otherwise than by reason of a default or other termination event), as well as any other derivative contract relating to assets, rights, obligations, indices and measures not otherwise mentioned in this Part, which have the characteristics of other derivative financial instruments, having regard to whether, inter alia, they are traded on a regulated market or an MTF, are cleared and settled through recognised clearing houses or are subject to regular margin calls.

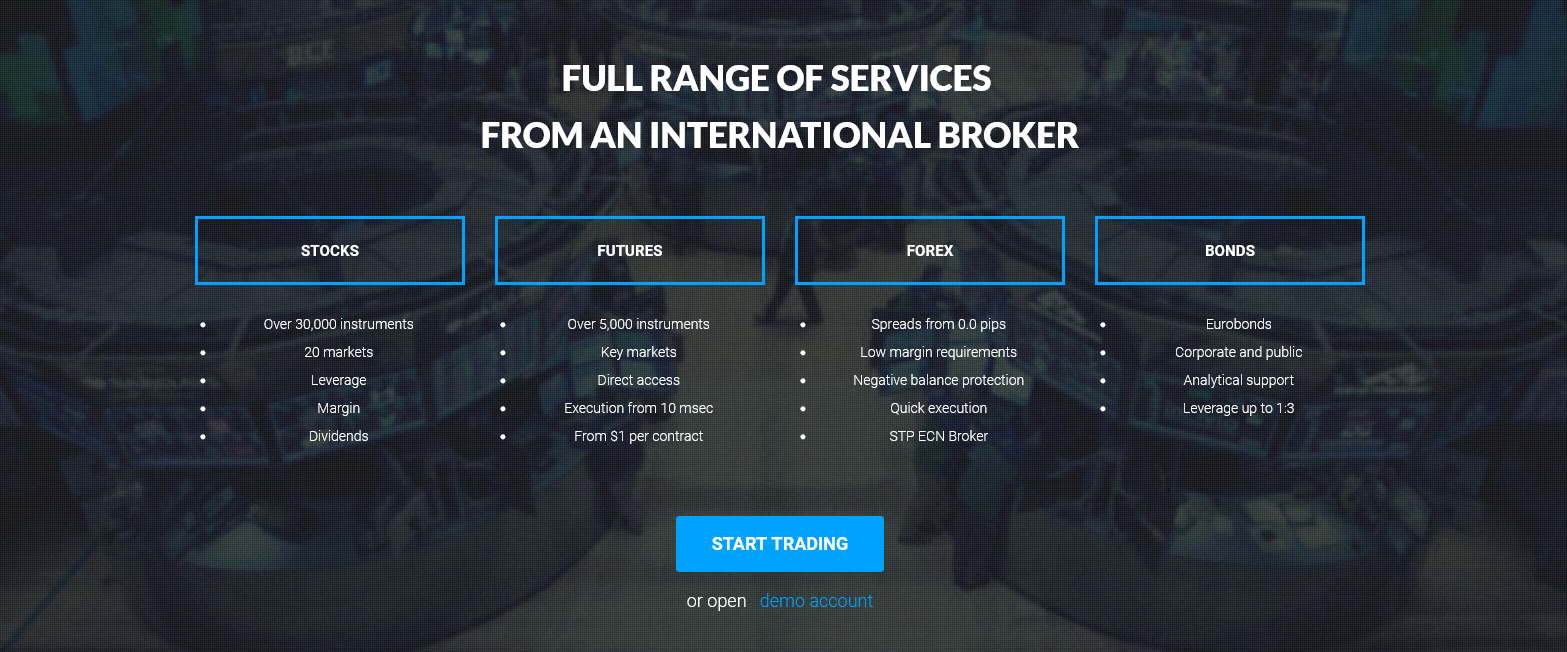

We are popular worldwide

Just2Trade provides brokerage services since 2007 and is trusted by 155,000 clients from 130 countries.

Just2Trade advantages

We stand out from many competitors, due to significant advantages

EU authorised and regulated broker

Just2Trade is subject to the strict supervision of European regulators

Direct access to the markets

Low commissions, instant execution and maximum liquidity

Support 24/7

Individual approach to each client

Professional analytical assistance

High-quality research: we cover all financial markets and instruments that have proven themselves worldwide

High-speed infrastructure

Our ultra-modern 100G network covers Europe, America, Asia and Russia, allowing us to maximize the speed of order execution

Institutional services

Enhanced cooperation opportunities: from the referral agent to introducing broker. We also provide possibility of integrating third-party trading programs through the Open API

Just2Trade is also waiting for you in the most rapidly developing markets of the world. Open Demo account to try your hand at trading in the financial market

Investment Services And Activities

Reception & Transmission of Orders in relation of one or more financial instruments

The objective of the Company is to offer the highest possible quality service of reception and transmission of orders to its Clients. All the required actions are taken to ensure that customers' interests are safeguarded and conflicts of interest are avoided.

Execution of Orders on behalf of clients

MiFID, the Market in Financial Instruments Directive, requires that Investment Firms take all reasonable steps to obtain the best overall result in the execution of an order for a Client. Just2Trade seeks the best possible terms reasonably available when executing a transaction on behalf of a Client, taking into account price, cost, speed, likelihood of execution and settlement, size, nature or any other consideration relevant to the execution of orders.

Portfolio Management

Just2Trade offers portfolio management services to individual and institutional investors. Once the investment objectives are clearly set, we are then able to develop a tailor made portfolio strategy to satisfy our Clients' objectives and expectations.

Investment Advice

Just2Trade advisory services help clients to make the right investment decisions to meet their financial objectives. We provide personal recommendations to Clients, either upon their request or at our initiative, in respect of one or more transactions relating to financial instruments.

Ancillary Services

Safekeeping and Administration of Financial Instruments for the account of the clients, including custodianship and related services such as cash/collateral management.

Granting Credits or Loans to an Investor to allow him to carry out a transaction in one or more financial instruments, where the Company granting the credits or loans is involved in the transactions.

Foreign Exchange Services where these are connected to the provision of investment services.

Investment research and financial analysis or other forms of general recommendations relating to transactions in financial instruments.

kra2kn.ccfag

Уровень приватности настолько высок, что можно быть спокойным. https://telegra.ph/Kak-ispolzovat-klyuchi-dlya-prodvizheniya-sajta-11-09Addie

взломанные игры с модами — это отличный способ изменить игровой опыт. Особенно если вы пользуетесь устройствами на платформе Android, модификации открывают перед вами новые возможности. Я нравится использовать игры с обходом системы защиты, чтобы достигать большего. Моды для игр дают невероятную персонализированный подход, что делает процесс гораздо захватывающее. Играя с модификациями, я могу повысить уровень сложности, что добавляет приключенческий процесс и делает игру более эксклюзивной. Это действительно захватывающе, как такие моды могут улучшить переживания от игры, а при этом с максимальной безопасностью использовать такие игры с изменениями можно без особых проблем, если быть внимательным и следить за обновлениями. Это делает каждый игровой процесс персонализированным, а возможности практически выше всяких похвал. Советую попробовать такие модифицированные версии для Android — это может придаст новый смыслAnthonyNok

Сайт для женщин https://modam.com.ua о жизни без перегруза: здоровье и красота, отношения и семья, карьера и деньги, дом и путешествия. Экспертные статьи, гайды, чек-листы и подборки — только полезное и применимое.TravisArive

Мода и красота https://magiclady.kyiv.ua для реальной жизни: капсулы по сезонам, уход по типу кожи и бюджета, честные обзоры брендов, шопинг-листы и устойчивое потребление.TravisArive

Мода и красота https://magiclady.kyiv.ua для реальной жизни: капсулы по сезонам, уход по типу кожи и бюджета, честные обзоры брендов, шопинг-листы и устойчивое потребление.